The Comprehensive Help guide to Flipping Real-estate: Techniques, Challenges, and Opportunities

Intro:

Flipping real estate property has received widespread acceptance as being a rewarding purchase method, engaging both experienced investors and newcomers equally. The allure of getting distressed qualities, renovating them, and selling for a large revenue is undeniable. However, profitable real estate turning needs not only a enthusiastic vision for potential it needs a strategic technique, thorough planning, and a thorough understanding of industry dynamics. This comprehensive information delves to the intricacies of turning property, investigating powerful methods, potential problems, and the myriad opportunities accessible to buyers.

Understanding Real Estate Property Turning:

Real-estate turning requires getting attributes, normally those needing repair or renovation, boosting them, and reselling them with a higher price. The target is always to gain a quick turnaround and maximize the improved residence importance post-reconstruction. Contrary to purchase-and-hold strategies, which focus on long term appreciation and hire revenue, flipping is centered on short-expression gains and speedy purchase cycles.

The Turning Procedure:

Finding the Right House: Successful turning starts with identifying the correct residence. Buyers often goal distressed attributes, foreclosures, or properties requiring significant repairs. Key places incorporate real-estate online auctions, banking institution-possessed properties (REOs), and distressed seller entries.

Carrying out Homework: Detailed due diligence is very important. This involves assessing the property's situation, estimating maintenance and renovation fees, and examining equivalent income (comps) in the community to look for the possible resale importance. Understanding local market developments and demand is additionally important.

Getting Loans: Loans a flick can be achieved through a variety of implies, which includes individual financial savings, hard cash personal loans, private lenders, or conventional mortgages. Hard money personal loans, although more pricey, are well-known because of their versatility and faster approval processes.

Improving the house: Reconstruction is definitely the cardiovascular system in the flipping method. Investors should center on cost-effective changes that significantly enhance the property's worth. This can consist of kitchen and bathroom remodels, floor coverings enhancements, clean painting, and curb appeal advancements. Managing remodelling timelines and finances is vital to capitalizing on profitability.

Advertising and Selling: As soon as remodeling are full, the property is listed available for purchase. Effective advertising tactics, which includes specialist taking photos, staging, and itemizing on a number of systems, are essential to draw in potential buyers. Partnering having a skilled real estate broker can help faster product sales and negotiation benefits.

Benefits associated with Flipping Property:

Substantial Profit Potential: Turning real estate property can generate substantial revenue inside a relatively brief time, especially in trading markets with soaring property values and high demand.

Fingers-On Investment: Unlike indirect expense methods, turning enables investors to actively take part at the same time, from home selection to remodelling and selling, providing a sense of control and achievement.

Market place Adaptability: Flipping enables brokers to easily get accustomed to market place conditions, taking advantage of brief-term trends and possibilities that may not line-up with long-term purchase tactics.

Talent Development: Turning hones a variety of abilities, such as property analysis, venture administration, negotiation, and industry evaluation, which can be useful for broader real estate property committing.

Challenges of Flipping Property:

Marketplace Volatility: Real-estate marketplaces may be volatile, and sudden downturns can affect reselling worth and earnings. Keeping yourself informed about market tendencies and economic signals is crucial to minimize hazards.

Reconstruction Risks: Unpredicted concerns during refurbishments, including architectural issues or code offenses, can cause price range overruns and project slow downs. Detailed house inspections and contingency preparing are very important.

Funding Costs: Higher-interest rates on tough dollars lending options as well as other quick-term loans options can consume into earnings in the event the residence does not sell quickly. Powerful financial administration and expense management are crucial.

Legitimate and Regulatory Agreement: Turning properties needs adherence to various community, state, and government rules, which includes developing codes, zoning laws, and make it possible for demands. Malfunction to comply can lead to fines and legitimate problems.

Techniques for Effective Flipping:

Extensive Market Research: In-depth consumer research is the reasons for effective turning. Understanding local market place dynamics, residence values, and shopper tastes assists establish worthwhile prospects and avoid overpaying for qualities.

Accurate Cost Estimation: Precisely estimating restoration fees and possible resale benefit is critical. Dealing with knowledgeable building contractors and using comprehensive venture strategies may help manage charges and avoid finances overruns.

Successful Project Managing: Powerful project management guarantees makeovers are done punctually and within spending budget. Normal development monitoring, clear conversation with companies, and adaptability in handling troubles are essential components.

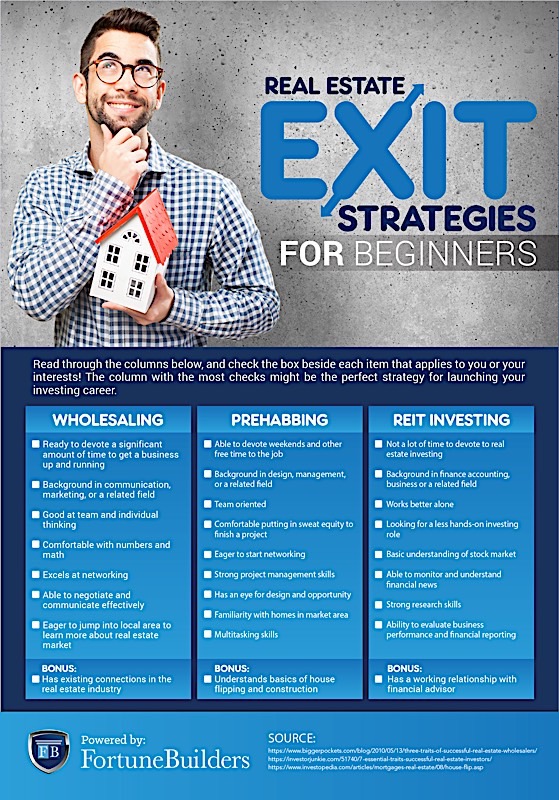

Get out of Strategy Organizing: Developing a crystal clear exit approach, whether marketing the property easily or hiring it in case the marketplace conditions are undesirable, provides a safety web and guarantees mobility in responding to market adjustments.

Networking and Relationships: Building a network of reliable installers, realtors, creditors, along with other experts offers valuable sources, assist, and possibilities for cooperation.

Options in Real Estate Flipping:

Emerging Market segments: Determining and investing in growing market segments with powerful progress possible can cause significant profits. These market segments usually have lower entrance charges and higher appreciation prices.

Distressed Qualities: Distressed components, which includes home foreclosures and quick sales, can be acquired at substantial savings, offering sufficient area to make money after refurbishments.

Luxurious Flips: Substantial-finish components in well-off communities can produce considerable earnings, though they need larger sized money investments as how to wholesale houses well as a excited comprehension of high end market styles.

Green Remodeling: how to wholesale property Adding environmentally friendly as well as-effective characteristics in renovations can entice environmentally conscious consumers and potentially be eligible for tax incentives or discounts.

Technologies Integration: Benefiting technologies, including internet organized tours, internet marketing, and undertaking administration application, can improve efficiency, bring in technician-experienced buyers, and improve the turning procedure.

Conclusion:

Turning real-estate offers a persuasive opportunity for traders trying to find quick returns and lively engagement inside the property market. When the potential of high earnings is significant, it comes with its reveal of difficulties and risks. Good results in turning needs a tactical technique, careful preparation, plus a deep comprehension of industry dynamics. By doing comprehensive investigation, managing makeovers successfully, and keeping yourself adaptable to advertise circumstances, traders can understand the complexities of turning and capitalize on the options it features. Whether you're a skilled investor or perhaps a novice to real estate community, flipping delivers a active and fulfilling pathway to economic growth and expenditure achievement.